This calculator will help you to estimate your annual gasoline cost given the type of car you drive, the number of miles you drive per year, and the price you are paying for a gallon of gasoline.

Current Columbus Auto Loan Rates

We publish current Columbus auto loan rates for new & used vehicles. Car buyers can use these quotes to estimate competitive loan rates before dealing with an auto dealership in a negotation where the dealer has the upper hand and charges too high of an interest rate or tries to require unneeded extended warrany programs as a condition for extending funding.

Fuel Budget Calculations

There are a variety of ways to satisfy transportation needs, including vehicle ownership, public transportation, and carpooling. Each carries distinct advantages, as well as associated costs. It is important for consumers to account for all of the expenses generated by each mode of transportation, before making prudent decisions about the best path forward.

Getting Around on a Budget

Modern citizens are accustomed to unrestricted mobility, commonly leading to car purchases; but there are other ways to get around too. Budget conscious consumers choose alternative modes of transportation to save money and act more responsibly in their fossil fuel use. Since gasoline is a cherished resource, environmental concerns lead some individuals to walk and bike to their destinations, rather than operating combustion engines to get around.

When free manpower is used, total transportation costs reflect huge savings over those compiled by burning gas. Other savings occur simultaneously too, as vehicle repair and maintenance costs are reduced by less wear and tear on vehicles. While bikers and walkers often own cars too, for longer trips and foul weather travel, they nonetheless trim gas costs by altering their transportation behavior.

Leasing vehicles provides another alternative, creating ownership-like usage privileges, without all the costs associated with buying cars. Under lease terms, motorists agree to pay a particular monthly rental fee for the use of vehicles. The length of each lease term varies, from single-year commitments up to several-year terms locking-in lessees for extended periods. To initiate leases, down payments are made, totaling at least a few months' worth of payments. After that, regular payments are made for the duration of each lease term, until the contract expires. Other terms, like mileage limitations and buy-out options govern lease deals, providing flexible transportation alternatives for diverse needs.

Tackling your transportation needs is accomplished by reviewing all of your options, choosing those most appropriate for your travel habits and operating budget. Though cost-efficient options exist, car ownership is still a primary approach toward getting around.

Operating Budgets for Car-Buyers

Car costs go well-beyond their purchase prices, requiring ongoing spending commitments to remain on the road. At purchase time, interest rates and financing options are buyers' primary concerns, but once procurement is in the rear-view mirror, car owners turn their attention to the other costs associated with vehicle ownership.

Insurance, for example, comes due based on the performance features of vehicles and the locations where they are stored. Newer cars, with high values, are subject to pricier premiums because their replacement costs are also high. Riskier zip codes also draw higher premiums for car owners, who don't always see them coming. Repair and maintenance expenses are a wild card for vehicle owners, throwing unanticipated payments toward vehicle upkeep. Buying a newer car helps offset repair costs, but comes with a higher price-tag initially.

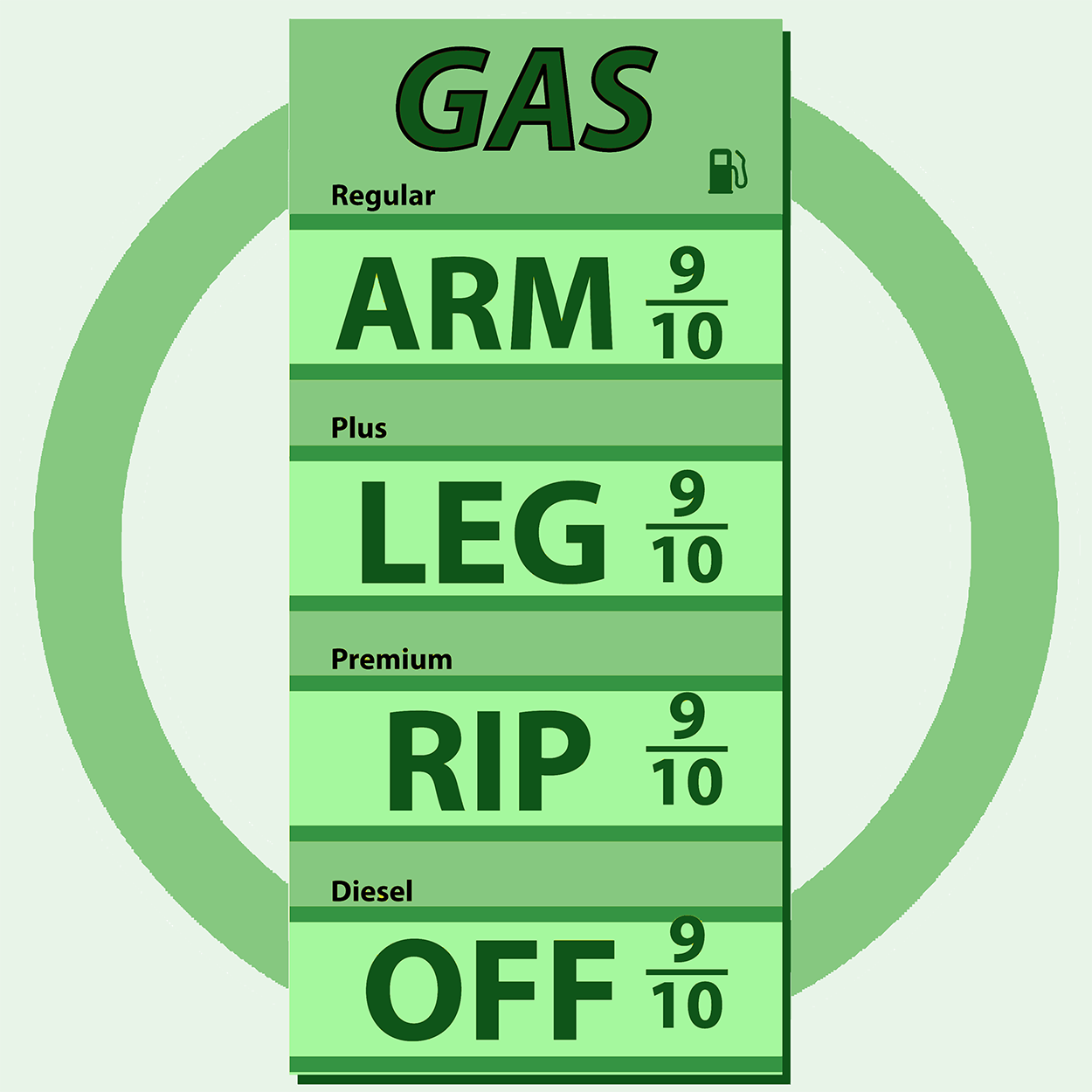

Gasoline expenses also weigh heavily on overall automobile operational budgets. Gas budget calculator distills your vehicles mileage and the prevailing price of gas, creating snapshots of ongoing fuel expenses. By evaluating various scenarios with the calculator, it is possible to compare and contrast the benefits and savings of moving in to a more fuel efficient vehicle. The tool provides invaluable money saving feedback, especially for high-mileage drivers.

Estimate Gasoline Budget

Estimate Gasoline Budget